Stocks Post Best Week in Two Months (PDF Version) (Additional Market Commentary) September 26, 2016 – U.S. stocks finished moderately lower on Friday, as investors were put off by a sharp decline in oil; yet following three days of gains, the S&P 500 posted its strongest weekly gain in two months. Oil prices fell nearly 4% on Friday after Saudi Arabia failed to reach an agreement with Iran to cut crude oil production. A number of key technology stocks posted big gains last week, along with relatively safe, strong dividend-paying stocks that investors generally favor when uncertain about the economy. Real Estate, in its first full week of trading as the S&P 500’s newest major sector group, surged 4.3%, its best performance since July. In key economic news last week, Federal Reserve FOMC members voted on Wednesday to leave interest rates unchanged for the sixth straight policy meeting. At her press conference following the announcement, Fed Chair Janet Yellen said the decision was not due to any lack of confidence in the economy but, instead, was “a calculation of cost and benefit” from low inflation, remaining labor market slack and the absence of strong pressure on manufacturing utilization (which might suggest overheating of the market). The FOMC’s next consideration for a rate hike is November 1-2, but with the national elections following so closely on November 8th, odds currently favor rate tightening to occur at the Fed’s December 14-15 meeting. For the week, the S&P 500 gained 1.20%, the Dow Industrials added nearly 138 points (+0.76%), and the NASDAQ Composite advanced 1.18% and set a new all-time high on Thursday. All eleven major sector groups posted gains last week, led by the 4.30% surge in Real Estate Investment Trusts (REITs), Utilities (+3.37%), and Telecom (+1.92%). Energy (+0.10%) rose the least. The US Dollar Index weakened by 0.65%, finishing the week at 95.477. Despite the Friday pullback, crude oil futures gained 1.97% last week; while gold and silver futures jumped 2.09% and 4.79% respectively. U.S. government bond prices rose on Friday, capping their best weekly rally since the end of July. Ten-year Treasury note yields, which decline as prices rise, fell 7.4 basis points last week to 1.619%.

|

Market Watch

Stocks | 1-Week | MTD | 3-Month | YTD | 1-Year | 3-Year |

Dow Jones Industrial Avg. | 0.76% | -0.76% | 1.39% | 4.80% | 12.15% | 5.84% |

S&P 500 | 1.20% | -0.18% | 2.97% | 7.62% | 14.10% | 10.66% |

NASDAQ Composite | 1.18% | 1.82% | 8.38% | 6.95% | 13.02% | 13.47% |

Russell 3000 | 1.37% | -0.01% | 3.39% | 8.00% | 13.18% | 10.07% |

MSCI EAFE | 3.15% | 1.92% | 2.23% | 2.43% | 6.77% | 0.49% |

MSCI Emerging Markets | 3.64% | 2.83% | 10.84% | 17.79% | 18.61% | -1.00% |

Bonds |

|

|

|

|

|

|

Barclays Agg Bond | 0.52% | -0.12% | 1.52% | 5.73% | 5.34% | 4.14% |

Barclays Municipal | 0.15% | -0.54% | 0.42% | 3.98% | 5.96% | 5.63% |

Barclays US Corp High Yield | 0.82% | 0.27% | 4.74% | 14.66% | 10.06% | 5.02% |

Commodities |

|

|

|

|

|

|

Bloomberg Commodity | 1.31% | 1.89% | -4.48% | 7.57% | -3.04% | -12.80% |

S&P GSCI Crude Oil | 1.97% | -0.49% | -11.24% | 20.09% | 0.00% | -24.55% |

S&P GSCI Gold | 2.40% | 2.31% | 6.22% | 26.55% | 18.54% | 0.37% |

Source: Morningstar

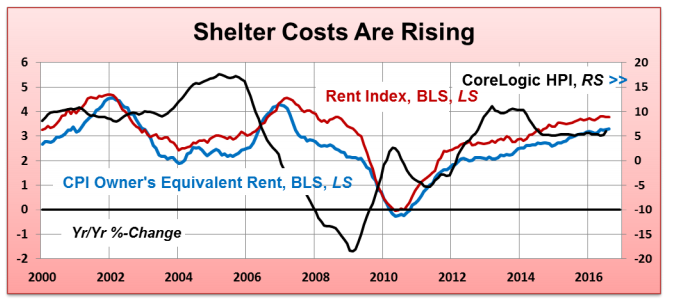

Chart of the Week: U.S. Housing Costs Are Rising

|

It is no surprise that shelter costs represent a large portion of the typical household budget. Accordingly, rent, paid either to a landlord or to oneself as an owner-occupant, has a large weighting in the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) deflator, the two major measures of U.S. consumer prices. According to CoreLogic, which maintains the broadest index of home prices in the country, the rate of home price appreciation has picked up noticeably in recent months. As is shown in the chart above, the twelve-month rise in home prices (black line) rose to 6% in July, up from 5.2% the month before. Home price inflation soared to 11.6% from February through July, up from just 1.6% in the previous five months. The Bureau of Labor Statistics’ Rent Index also continues to climb steadily, reaching 3.8% in August, the fastest rise since September 2008. Rentals constitute a little more than 7% of the entire CPI basket. The CPI component of Owners’ Equivalent Rent (OER) has reached 3.3%, the fastest rise since May 2007. This estimate is based on consumers who rent their primary residence and it comprises about 25% of the CPI. The OER inflation has consistently been slower than that of actual rentals. |

|